Rent to Value

A rate of return of a rental property based on comparing the monthly gross rent to the purchase price or market value.

The rent to value ratio is used by the common 1% Rule and 2% Rule.

-0001.jpg/:/cr=t:18.1%25,l:0%25,w:100%25,h:64.94%25/rs=w:600,h:300,cg:true)

Gross Rent Multiplier (GRM)

A rate of return of a rental property based on comparing the purchase price or market value to the yearly gross rent.

The gross rent multiplier shows the number of years it will take for the yearly gross rent to add up to the original purchase price.

Equity Multiple

A ratio that shows the total rate of return of a rental property based on comparing the total profit from your investment to the total invested cash.

The equity multiple takes into account the cumulative cash flow, equity accumulation and loan pay-down and gives the total cumulative return on your invested capital, should you decide to sell the property at a given point in time.

The equity multiple is the same as the ROI, except expressed as a ratio.

Break Even Ratio (BER)

A ratio that compares the property's yearly operating expenses and debt service (loan payments) to its potential yearly gross rent.

The break even ratio shows the minimum percentage of occupancy needed to cover all operating expenses and debt service obligations for a rental property.

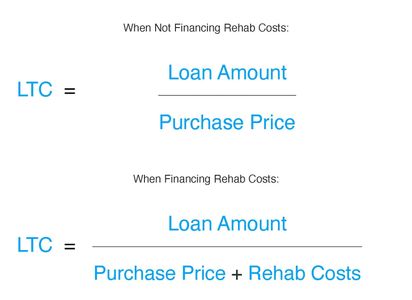

Loan to Cost Ratio (LTC)

A ratio between the loan amount and the acquisition costs of a property, consisting of the purchase price and rehab costs, if they are being financed.

The LTC ratio is often used by lenders as an indication of lending risk when approving new loans.

A higher LTC ratio may result in a loan denial, higher interest rates or the addition of mortgage insurance.

Loan to Value Ratio (LTV)

A ratio between the loan amount and the market value of a property.

The LTV ratio is often used by lenders as an indication of lending risk when approving new loans.

A higher LTV ratio may result in a loan denial, higher interest rates or the addition of mortgage insurance.

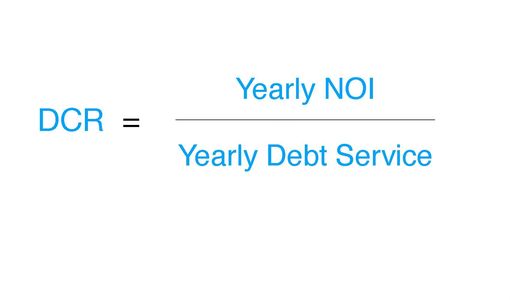

Debt Coverage Ratio (DCR, DSCR)

A ratio that compares the property's yearly NOI to its yearly debt service - the total principal and interest payments on the loan.

The debt coverage ratio, sometimes also called the debt service coverage ratio, is often used by lenders to determine loan eligibility.

A debt coverage ratio below 1 indicates that there is not enough cash flow to cover the debt service, and may result in a loan denial.

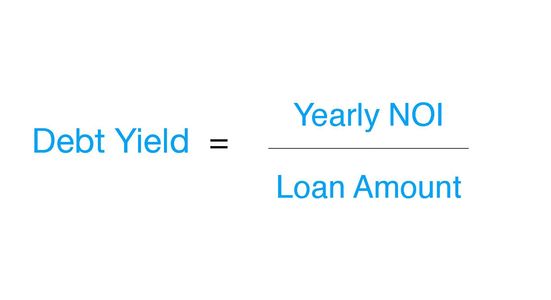

Debt Yield

A ratio that compares the property's yearly NOI to the total loan amount.

The debt yield is often used by lenders to determine loan eligibility, as an indication of leverage and loan risk.

A lower debt yield indicates higher leverage and therefore higher risk, while a higher debt yield indicates lower leverage and therefore lower risk.

Subscribe

Tune in to all our real estate news and discounts.

Ocean County Investments LLC

Mailing address: 1001 Fischer Blvd. Suite 3, #201 Toms River, NJ 08753

Copyright © 2020 Ocean County Investments - All Rights Reserved.