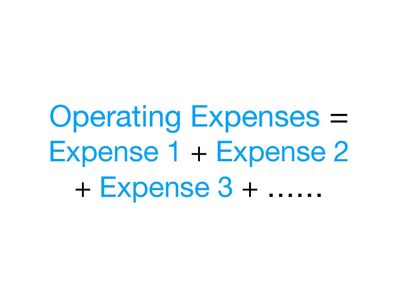

Operating Expenses

All expenses you will incur while renting out a property, excluding any loan payments.

Examples include: property taxes, insurance, property management fees, maintenance, capital expenditures and utilities.

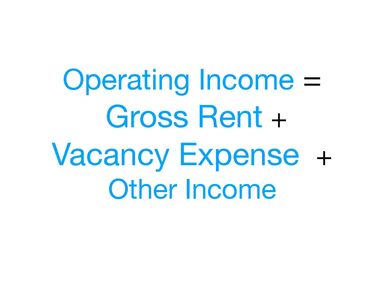

Operating Income

Total income generated by a rental property, less the vacancy expense. Sometimes also called effective gross income (EGI).

.jpg/:/cr=t:20.93%25,l:0%25,w:100%25,h:58.14%25/rs=w:600,h:300,cg:true)

Net Operating Income (NOI)

Net income generated by a rental property.

While NOI takes into account all operating expenses, it does not account for loan payments.

It can therefore be used to compare rental properties irrespective of financing terms.

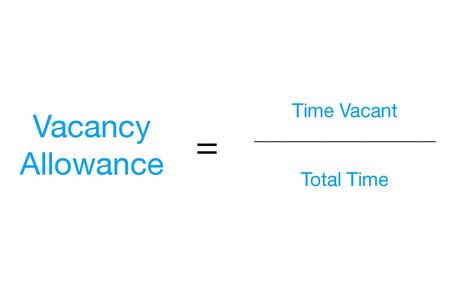

Vacancy Allowance

A percentage of time you expect a rental property to remain vacant.

The property may remain vacant while you are searching for a new tenant or rehabbing it.

For example, if you expect the property to remain vacant for 1 month each year, the vacancy allowance will be 8.3%.

Vacancy Expense

The amount you will lose in a given time period due to vacancy.

While vacancy isn't a direct expense in the sense that you do not pay it to anyone, it will result in a decrease in collected gross rent.

Total Equity

The actual portion of the property's market value that you own.

If you are using financing, your initial equity will depend on your loan down payment.

Your equity will increase as you pay down your loan and as the property's market value increases.

Total Cash Invested

The total amount of capital you have invested in a property.

For traditional rental properties and flips, this amount will equal to the total cash you have spent to purchase and rehab the property.

For BRRRR deals, this amount will usually be less than initially invested cash, as you will get some cash back after the refinance is complete. It is also possible to receive more cash back than what you originally invested, making your total investment in the property 0 or even negative.

Total Cash Needed

The total amount of cash you will need to purchase and rehab a property.

Subscribe

Tune in to all our real estate news and discounts.

Ocean County Investments LLC

Mailing address: 1001 Fischer Blvd. Suite 3, #201 Toms River, NJ 08753

Copyright © 2020 Ocean County Investments - All Rights Reserved.